UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934 (Amendment No. )

|

| | |

Filed by the Registrant ý |

Filed by a Party other than the Registrant o |

| Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12 |

|

| | | |

DYNAMIC MATERIALS CORPORATIONDMC GLOBAL INC. |

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required. |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | Title of each class of securities to which transaction applies: |

| | | (2) | Aggregate number of securities to which transaction applies: |

| | | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | (4) | Proposed maximum aggregate value of transaction: |

| | | (5) | Total fee paid: |

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | Amount Previously Paid: |

| | | (2) | Form, Schedule or Registration Statement No.: |

| | | (3) | Filing Party: |

| | | (4) | Date Filed: |

DYNAMIC MATERIALS CORPORATIONDMC GLOBAL INC.

(formerly Dynamic Materials Corporation)

5405 Spine Road

Boulder, Colorado 80301

NOTICE OF SPECIALANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON NOVEMBER 4, 2016May 18, 2017

|

| |

| | |

To the Stockholders of DYNAMIC MATERIALS CORPORATION:DMC Global Inc.:

| September 23, 2016April 5, 2017 |

NOTICE IS HEREBY GIVEN that a Specialthe Annual Meeting of Stockholders of DYNAMIC MATERIALS CORPORATION,DMC GLOBAL INC., a Delaware corporation, (the "Company"), will be held on November 4, 2016,May 18, 2017, at 8:30 a.m. local time at the Company's offices at 5405 SpineHampton Inn, 6333 Lookout Road, Boulder, Colorado, for the following purposes:

1.To approveelect the amendmenteight director nominees identified in the accompanying proxy statement to hold office until the 2018 Annual Meeting of the Company’s Certificate of Incorporation to change the name of the Company from Dynamic Materials Corporation to DMC Global Inc. and to make certain other changes;Stockholders;

2.To approve a non-binding, advisory vote on executive compensation;

3.To approve a non-binding, advisory vote on the Company's 2016 Omnibus Incentivefrequency of advisory votes on executive compensation;

4.To approve an amendment of the Company’s Employee Stock Purchase Plan;

5.To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ended December 31, 2017; and

3.6.To transact such other business as may properly come before the meeting or any adjournment or postponement thereof.

The foregoing items of business are more fully described in the proxy statement accompanying this notice.

The Board of Directors has fixed the close of business on September 14, 2016,March 24, 2017, as the record date for the determination of stockholders entitled to notice of, and to vote at, this SpecialAnnual Meeting and at any adjournment or postponement thereof.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be Held on May 18, 2017. Similar to last year, we will be using the "Notice“Notice and Access"Access” method that allows companies to provide proxy materials to stockholders via the Internet. On or about September 23, 2016,April 5, 2017, we will mail to our stockholders a Notice of Internet Availability of Proxy Materials which contains specific instructions on how to access SpecialAnnual Meeting materials via the Internet, as well as instructions on how to request paper copies. We believe this process should provide a convenient way to access your proxy materials and vote. The Proxy Statement and our annual report on Form 10-K for the fiscal year ended December 31, 2016 are available at www.edocumentview.com/boom.

|

| |

| | By Order of the Board of Directors, |

| | /s/ Michelle H. Shepston |

| | MICHELLEMichelle H. SHEPSTON

Shepston

Chief Legal Officer and Secretary |

Boulder, Colorado

ALL STOCKHOLDERS ARE CORDIALLY INVITED TO ATTEND THE MEETING IN PERSON. WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, PLEASE FOLLOW THE INSTRUCTIONS PROVIDED TO YOU AND VOTE YOUR SHARES AS PROMPTLY AS POSSIBLE IN ORDER TO ENSURE YOUR REPRESENTATION AT THE MEETING. EVEN IF YOU HAVE GIVEN YOUR PROXY, YOU MAY STILL VOTE IN PERSON IF YOU ATTEND THE MEETING. PLEASE NOTE, HOWEVER, THAT IF YOUR SHARES ARE HELD OF RECORD ARE HELD BY A BROKER, BANK OR OTHER

NOMINEE AND YOU WISH TO VOTE AT THE MEETING, YOU MUST OBTAIN FROM SUCH RECORD HOLDER A PROXY ISSUED IN YOUR NAME.

PROXY STATEMENT TABLE OF CONTENTS

|

| |

| | Page |

20162017 PROXY SUMMARY | |

INFORMATION CONCERNING THE SPECIALANNUAL MEETING AND VOTING | |

PROPOSAL 1—APPROVALELECTION OF AMENDMENTS TO THE CERTIFICATE OF INCORPORATIONDIRECTORS | |

| NOMINEES | |

PROPOSAL 2—APPROVALNON-BINDING ADVISORY VOTE TO APPROVE EXECUTIVE COMPENSATION | |

| PROPOSAL 3—NON-BINDING ADVISORY VOTE ON THE FREQUENCY OF ADVISORY VOTES ON EXECUTIVE COMPENSATION | |

| PROPOSAL 4—AMENDMENT OF EMPLOYEE STOCK PURCHASE PLAN | |

| PROPOSAL 5—RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | |

REPORT OF THE 2016 OMNIBUS INCENTIVE PLANAUDIT COMMITTEE OF THE BOARD OF DIRECTORS | |

| REPORT OF THE COMPENSATION COMMITTEE OF THE BOARD OF DIRECTORS | |

| COMPENSATION DISCUSSION AND ANALYSIS | |

| SUMMARY COMPENSATION TABLE FOR FISCAL YEAR 2016 | |

| NON-QUALIFIED DEFERRED COMPENSATION | |

| GRANTS OF PLAN-BASED AWARDS IN FISCAL YEAR-END 2016 | |

| EMPLOYMENT AGREEMENTS | |

| OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END 2015 | |

| STOCK VESTED DURING 2016 | |

| POTENTIAL PAYMENTS UPON TERMINATION | |

| DIRECTOR COMPENSATION | |

| EQUITY COMPENSATION PLAN INFORMATION | |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | |

| HOUSEHOLDING | |

| OTHER MATTERS | |

Summary

Performance, Executive Pay, and Stockholder Say on Pay

This proxy statement relates to the 2017 Annual Meeting of Stockholders of DMC Global Inc. At the meeting, stockholders will be asked to vote on non-binding proposals regarding the company’s executive compensation and the frequency of future votes on executive compensation. While these proposals are described in more detail in Proposal 2- Advisory Vote to Approve Executive Compensation and Proposal 3- Advisory Vote on the Frequency of Advisory Votes on Executive Compensation, the following provides a brief summary of certain factors the Board of Directors considers relevant to these matters.

2016 Performance

During the last three years, a new senior management team directed a series of restructuring, consolidation and modernization initiatives designed to improve efficiencies and strengthen the competitiveness of our two operating businesses. These initiatives took on increased importance following the 2014 collapse of the global energy industry, from which we derive approximately 70% of our consolidated sales. In particular:

At our DynaEnergetics business, initiatives included the consolidation of Canadian manufacturing operations into existing facilities in Texas, and the closure of 10 North American distribution centers.

Our NobelClad business centralized the majority of its European manufacturing into a new production facility in Liebenscheid, Germany.

We modernized and upgraded all of our facilities and commissioned and completed new facilities in Blum, Texas and Tyumen, Siberia.

We completed a comprehensive re-branding of DMC and both business units.

Both businesses modernized their IT and financial management systems.

We invested heavily in research, technology and application development programs, and these investments have led to several new product introductions and a significant increase in DynaEnergetics’ market share.

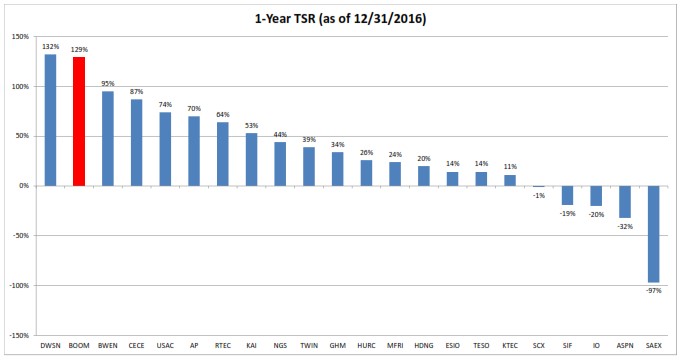

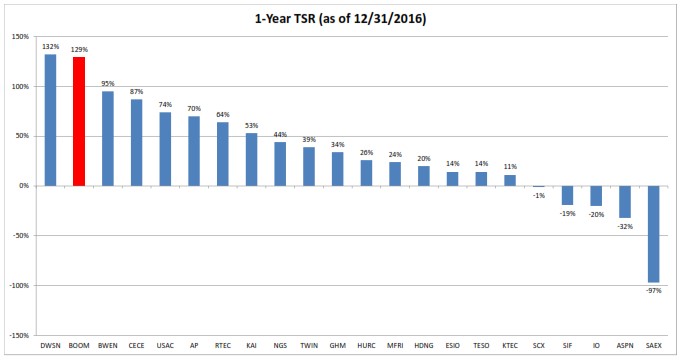

In 2016, despite the challenges in the global energy market, the new management team’s efforts began to bear fruit, resulting in a one-year total stockholder return (“TSR”) in excess of 100%, ranking first among our 2016 performance peer group.

DYNAMIC MATERIALS CORPORATION

In late 2016, the Compensation Committee adopted a new peer group to better match the consolidated business of DMC and to include energy and oil field services companies. Our one year TSR for 2016, as compared to our new peer group is as follows:

2016 Pay

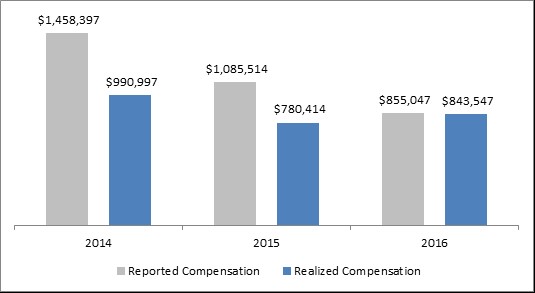

Despite the improvement in TSR, Company performance continued to be impacted by the severe downturn in the global energy markets, resulting in compensation for our Chief Executive Officer remaining significantly lower than pre-2015 levels for the second consecutive year. Mr. Longe’s 2016 total direct compensation (including base salary, annual incentive compensation and long-term equity awards) was $855,047 and his 2015 total direct compensation was $1,085,514, compared with total direct compensation of $1,458,397 in 2014 and $1,289,693 in 2013. The comparison of reported compensation versus realized compensation in 2014-2016 as discussed below further demonstrates the impact of our pay for performance compensation structures.

Pay for Performance Culture

The Company remains committed to providing compensation that is aligned with performance, especially in this challenging market environment. In order to strengthen the pay for performance linkage in the Company’s compensation packages, over the course of the past three years the Compensation Committee has worked to ensure that compensation for our named executive officers is aligned with stockholder value creation. These efforts have included:

| |

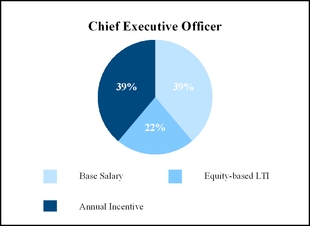

| ▪ | Structuring compensation with the objective that more than 60% of total direct compensation for our CEO is performance based; |

| |

| ▪ | Freezing salaries for named executive officers in the face of challenging market conditions; |

| |

| ▪ | Designing performance goals with sufficient stretch that the impact of the industry downturn has resulted in realized compensation well below compensation targets; and |

| |

| ▪ | Conserving cash by paying the 2015 performance bonus in restricted stock instead of cash. |

Reported Versus Realized Compensation

Below is a summary of reported compensation for our CEO in 2014, 2015 and 2016, as compared to realized compensation in those same periods. Realized compensation is calculated to include (a) base salary, (b) actual cash incentive bonus earned for the applicable year, (c) the value of shares of restricted stock vesting during the year, whether deferred or paid to the employee, and whether due to time or performance vesting, and (d) all other compensation paid (or earned) during the applicable year (which is included in the “All Other Compensation” column of the Summary Compensation Table for the applicable year). Please see “Compensation Discussion and Analysis- Reported versus Realized Compensation” for additional details.

DMC CEO REPORTED VS. REALIZED COMPENSATION DATA

DMC GLOBAL INC.

5405 Spine Road

Boulder, Colorado 80301

PROXY STATEMENT

FOR SPECIALTHE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON NOVEMBER 4, 2016May 18, 2017

2017 Proxy Summary

This summary highlights and supplements information contained elsewhere in this proxy statement. The summary does not contain all of the information that you should consider and the entire proxy statement should be read carefully before voting.

SpecialAnnual Meeting of Stockholders

Time and Date 8:30 a.m., November 4, 2016May 18, 2017

Place Company Offices, 5405 SpineHampton Inn, 6333 Lookout Road, Boulder, Colorado

Record Date September 14, 2016March 24, 2017

Agenda

The election of the eight director nominees identified in this proxy statement

An advisory vote on executive compensation

An advisory vote on the frequency of advisory votes on executive compensation

Approval of thean amendment of the Company's Certificate of Incorporation to change the Company's name and make certain other changesCompany’s Employee Stock Purchase Plan

ApprovalA ratification of the Company's 2016 Omnibus Incentive Planselection of Ernst & Young LLP as our independent registered public accounting firm for 2017

Such other business as may properly come before the meeting

|

| | |

| Proposal | Board Recommendation | Page Reference (for more detail) |

1. ApprovalElection of the amendment of the Company's Certificate of Incorporation to change the Company's name and make certain other changesdirectors | FOR | |

2. Approval of the Company's 2016 Omnibus Incentive Plan | FOR each Nominee | |

| 2. Advisory vote on executive compensation | FOR | |

| 3. Advisory vote on the frequency of advisory votes on executive compensation | ONE YEAR | |

| 4. Approval of the Amendment of the Company’s Employee Stock Purchase Plan | FOR | |

| 5. Approval of Ernst & Young LLP as auditor for 2017 | FOR | |

INFORMATION CONCERNING THE SPECIALANNUAL MEETING AND VOTING

General

The Board of Directors (the "Board") of Dynamic Materials Corporation,DMC Global Inc., a Delaware corporation, (the "Company"), is soliciting proxies for use at the SpecialAnnual Meeting of Stockholders to be held on November 4, 2016,May 18, 2017, at 8:30 a.m., local time (the “Annual Meeting”), or at any adjournment or postponement thereof, for the purposes described in this proxy statement and in the accompanying Notice of SpecialAnnual Meeting. The SpecialAnnual Meeting will be held at the Company's Offices which areHampton Inn, located at 5405 Spine6333 Lookout Road, Boulder, Colorado. On or about September 23, 2016,April 5, 2017, we will mail to all stockholders entitled to vote at the meeting, a Notice of Internet Availability of Proxy Materials that contains specific instructions on how to access SpecialAnnual Meeting materials via the Internet, as well as instructions on how to request paper copies. Unless the context otherwise requires, references to "the“the Company," "we," "us"” “DMC,” “we,” “us” or "our"“our” refer to Dynamic Materials Corporation.DMC Global Inc

Solicitation

We will bear the entire cost of solicitation of proxies.proxies, including preparation, assembly, printing and mailing of the Notice of Internet Availability of Proxy Materials and any additional information furnished to stockholders. Copies of solicitation materials will be furnished to banks, brokerage houses, fiduciaries, and custodians holding in their names shares of our common stock beneficially owned by others to forward to such beneficial owners. We may reimburse persons representing beneficial owners of common stock for their costs of forwarding solicitation materials to such beneficial owners. Original solicitation of proxies via the Internet may be supplemented by mail, telephone, telegram, or personal solicitation by our directors, officers, or other regular employees. No additional compensation will be paid to directors, officers, or other regular employees for such services.

Outstanding Shares and Quorum

Only holders of record of common stock at the close of business on September 14, 2016,March 24, 2017, will be entitled to notice of and to vote at the SpecialAnnual Meeting. At the close of business on September 14, 2016,March 24, 2017, we had 14,489,09414,725,591 shares of common stock outstanding and entitled to vote. Each holder of record of common stock on such date will be entitled to one vote for each share held on all matters to be voted upon at the SpecialAnnual Meeting.

A majority of the outstanding shares of common stock entitled to vote represented in person or by proxy will constitute a quorum at the SpecialAnnual Meeting. However, if a quorum is not represented at the SpecialAnnual Meeting, the stockholders entitled to vote at the meeting, present in person or represented by proxy, have the power to adjourn the SpecialAnnual Meeting from time to time, without notice other than by announcement at the SpecialAnnual Meeting, until a quorum is present or represented. At any such adjourned meeting at which a quorum is present or represented, any business may be transacted that might have been transacted at the originally scheduled meeting.

Voting Rights and Procedures

Votes cast by proxy or in person will be counted by one or more persons appointed by us to act as inspectors (the "Election Inspectors"“Election Inspectors”) for the SpecialAnnual Meeting. The Election Inspectors will treat shares represented by proxies that reflect abstentions as shares that are present and entitled to vote for the purpose of determining the presence of a quorum. Abstentions will not have any effect for approvalon any of proposal 2 but will have the same effect as a vote against proposal 1.proposals to be considered at the Annual Meeting.

Broker non-votes occur when a broker holding stock in street name voteslacks authority to vote the shares on some matters but not others.matters. Brokers are permitted to vote on routine, non-controversial“routine” proposals in instances wherewhen they have not received voting instruction from the beneficial owner of the stock but are not permitted to vote on non-routine matters. The missing votes on non-routine matters in the absence of such an instruction. Proposal 5 relating to the ratification of the appointment of Ernst & Young LLP as our independent registered accounting firm for the fiscal year ending December 31, 2017 is considered “routine,” and no broker non-votes are deemed to be "broker non-votes." Proposal 1 to amend our Certificate of Incorporation would be considered routine,expected for such proposal, but brokers will not be allowed to vote without instruction on proposalproposals 1, 2, because approval of compensation plans are not consider routine under the rules governing brokers.3 or 4. The Election Inspectors will treat broker non-votes as shares that are present and entitled to vote for the purpose of determining the presence of a quorum. Broker non-votes are not expected for proposal 1 and will have no effect on proposal 2. Wproposals 1, 2, 3 or 4. eWe urge you to give voting instructions to your broker on all proposals.

Directors are elected by a plurality of the votes cast by the holders of shares entitled to vote in the election at a meeting at which a quorum is present. Proxies may not be voted for a greater number of persons than there are nominees.

The non-binding advisory vote on the compensation of our named executive officers is subject to the approval of the affirmative vote of a majority of votes cast with respect to Proposal 2.

The frequency of non-binding advisory votes on executive compensation is subject to the approval of the affirmative vote of a majority of votes cast with respect to Proposal 3. If none of the three alternatives receives such a vote, the Board will consider the alternative that receives the most votes to be the frequency recommended by stockholders.

The approval of the amendment to our Employee Stock Purchase Plan requires the affirmative vote of a majority of votes cast with respect to Proposal 4.

The ratification of our selection of Ernst & Young LLP as our independent registered public accounting firm will be subject to the approval of an affirmative vote of a majority of votes cast with respect to Proposal 5.

If no direction is indicated on a proxy card, the shares will be voted FOR each of the proposals set forth in this proxy statement. The persons named in the proxies will have discretionary authority to vote all proxies with respect to additional matters that are properly presented for action at the Annual Meeting.

Appraisal Rights

No action is proposed at the Annual Meeting for which the laws of the state of Delaware or our Bylaws provide a right of our stockholders to dissent and obtain appraisal of or payment for such stockholder’s common stock.

Revocability of Proxies

Any person giving a proxy pursuant to this solicitation has the power to revoke it at any time prior to the SpecialAnnual Meeting. It may be revoked by filing with our Secretary at our principal executive office, 5405 Spine Road, Boulder, Colorado 80301, a written notice of revocation or a duly executed proxy bearing a later date, or it may be revoked by attending the meeting and voting in person. Attendance at the meeting will not, by itself, revoke a proxy.

Voting Your Shares

Stockholder of Record: If no direction is indicated,you are a stockholder of record, there are several ways for you to vote your shares, as follows:

Via the Internet: If you received a Notice of Internet Availability of Proxy Materials, you can access our proxy materials and vote online. Instructions to vote online are provided in the Notice.

By Telephone: You may vote your shares by calling the telephone number specified on your proxy card. You will need to follow the instructions on your proxy card and the voice prompts.

By Written Proxy: If you have received or requested a paper copy of the proxy materials, please date and sign the proxy card and return it promptly in the accompanying envelope.

In Person: All stockholders of record may vote in person at the Annual Meeting. For those planning to attend in person, we also recommend submitting a proxy card or voting by telephone or via the Internet to ensure that your vote will be voted FOR each counted if you later decide not to attend the meeting.

Beneficial Owner: If you are a beneficial owner, you should have received voting instructions from your broker, bank or other nominee. Beneficial owners must follow the voting instructions provided by their nominee in order to direct such broker, bank or other nominee as to how to vote their shares. The availability of telephone and Internet voting depends on the voting process of such broker, bank or nominee. Beneficial owners must obtain a legal proxy from their broker, bank or nominee prior to the Annual Meeting in order to vote in person.

Stockholder Proposals

Proposals of stockholders that are intended to be presented at our 2018 Annual Meeting of Stockholders and to be included in our proxy materials for the meeting must be received by us not later than December 6, 2017, in order to be included in the proxy statement and proxy relating to that annual meeting.

Notice of any stockholder proposal to be considered at our 2018 Annual Meeting, but not included in the proxy materials, must be submitted in writing and received by us not later than 60 days and not earlier than 90 days prior to the first anniversary of this year's annual meeting date; provided, however, that in the event that fewer than 70 days' notice or public announcement

of the proposals set forth in this proxy statement. The persons named indate of the proxies will have discretionary authoritymeeting is given or made to vote all proxies with respectstockholders, to additional matters that are properly presented for action atbe timely, notice by the Special Meeting.stockholder must be received not later than the close of business of the tenth day following the day on which we first publicly announce the meeting date.

PROPOSAL 1 - APPROVAL1—ELECTION OF AMENDMENTS TO THE CERTIFICATE OF INCORPORATIONDIRECTORS

There are eight nominees for election to the Board. Each director to be elected will hold office until the 2018 Annual Meeting of Stockholders. In any event, a director elected at the Annual Meeting will hold office until his successor is elected and is qualified, or until such director’s earlier death, resignation, or removal.

Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the eight nominees named below. In the event that any nominee should be unavailable for election as a result of an unexpected occurrence, such shares will be voted for the election of such substitute nominee as the Corporate Governance and Nominating Committee of the Board may propose. Each person nominated for election has agreed to serve if elected, and the Board has no reason to believe that any nominee will be unable to serve.

NOMINEES

The names of the nominees and certain information about them are set forth below. In addition, we have included information about each nominee's specific experience, qualifications, attributes or skills that led our Board of Directors to conclude that the nominee should serve as a director of the Company proposesat the time we are filing this proxy statement, in light of our business and corporate strategy.

|

| | | |

| | |

| Name | Position | Age |

| Gerard Munera | Chairman of the Board | 81 |

|

| Kevin T. Longe | Director, President and Chief Executive Officer | 58 |

|

| David C. Aldous | Director | 60 |

|

| Yvon Pierre Cariou | Director | 71 |

|

| Robert A. Cohen | Director | 68 |

|

| James J. Ferris | Director | 73 |

|

| Richard P. Graff | Director | 70 |

|

| Clifton Peter Rose | Director | 66 |

|

Gerard Munera. Mr. Munera has served as a director since September 2000 and as Chairman of the Board since May 2013. From 1996 to amendthe present, Mr. Munera has been General Manager of Synergex Group LLC, a family controlled holding company with diversified investments, including real estate, securities, gold mining and high technology industries and Executive Chairman of Arcadia, Inc., a family controlled private manufacturer of glass/aluminum products. Mr. Munera is a current director of one public company, Nevsun Resources Ltd., as well as two private companies. From 1994 to 1996, Mr. Munera was Chairman and CEO of Latin American Gold Inc., a gold exploration and mining company. Between 1991 and 1994, Mr. Munera was President and CEO of Minorco (USA), a diversified $1.5 billion natural resources group. Between 1990 and 1991, Mr. Munera was Senior Vice President of Corporate Planning and Development and a member of the Executive Committee of RTZ plc, a British mining and mineral processing company. Mr. Munera is a graduate of Ecole Polytechnique and Ecole Nationale des Ponts et Chaussees, both in Paris.

As a director of the Company for over a decade and a half, Mr. Munera has detailed knowledge of the Company's Certificatedevelopment, historical business cycles and customer base. From his prior executive and director roles, he has extensive experience in the mining and metallurgical industries, a key customer base of Incorporationthe Company's explosion welding division. With over five decades of successful business experience, he also brings solid international expertise, financial literacy, and deep management experience, as well as extensive work in strategic planning and implementing corporate goals. As a current and past director to changeother public companies, he brings experience and insight to the nameBoard on corporate governance and leadership issues.

Kevin T. Longe. Mr. Longe became our President and Chief Executive Officer in March 2013. He has served as a director since joining the Company in July 2012 as our Chief Operating Officer. From March 2011 until agreeing to join the Company, Mr. Longe served as an executive of Sonoco, Inc., first as President of Sonoco's Thermo Safe business from March 2011 to March 2012 and then from March 2012 to July 2012 as a Vice President and General Manager with Sonoco's Protective Packaging Division. From April 2010 until joining Sonoco, Mr. Longe was self-employed performing consulting and investment work. From 2004 through April 2010, Mr. Longe served in various

positions at Lydall, Inc., most recently (2007-2010) serving as president of its subsidiary, Lydall Performance Materials, Inc. Mr. Longe holds a B.B.A, with distinction, from The University of Michigan and an M.B.A, with distinction, from the J.L. Kellogg Graduate School of Management at Northwestern University.

We believe it is important to have our Chief Executive Officer also serve as a director to properly align management's execution of our business objectives with the oversight and direction of the Board. Mr. Longe brings extensive operating and strategic planning and implementation experience from his leadership roles in other larger multinational companies. On the operations side, he brings deep experience in manufacturing, marketing and sales, supply-chain management, and talent development as well as strong financial analysis and management skills. In selecting Mr. Longe as the Company's Chief Executive Officer, the Board also focused on his strategic vision and planning expertise and teambuilding and leadership skills to grow the Company within its existing businesses and potentially through acquisitions.

David C. Aldous. Mr. Aldous was appointed by the Board as a director in July 2013. Since March 2012, he has served as the Chief Executive Officer and Director of Rive Technology Inc., a privately-held provider of solutions for diffusion-limited reactions to the energy, chemicals, biofuel and water industries. Prior to joining Rive Technology Inc., Mr. Aldous served as Chief Executive Officer and Director of Range Fuels Inc., a clean energy and biofuels company from January, 2009 to February, 2012. Mr. Aldous also was employed for more than 20 years by Royal Dutch Shell, most recently as Executive Vice President, Strategy and Portfolio. Mr. Aldous also served as President of Shell Canada Products, where he led an $11 billion integrated oil business. Mr. Aldous also served as President, CEO and Director at CRI/Criterion Inc., a $1 billion global catalyst company. Mr. Aldous holds a B.S. in Fuels Engineering from the University of Utah and an M.B.A., with distinction, from the J.L. Kellogg Graduate School of Management at Northwestern University.

The Board added Mr. Aldous as a member in 2013 to strengthen the Board’s insight and experience in the energy and chemical processing industries, the primary end customer markets for NobelClad. His experience in the oil industry has been valuable as the Board considers how to best grow our DynaEnergetics business. With his over 30 years of corporate leadership experience in the energy, alternative energy, chemical and petrochemical industries, he brings extensive skills in strategic planning and corporate development, key focuses of the Board, in the industries in which the Company and its customers operate. As an acting chief executive officer, he also brings current and practical experience in leadership of global operations, financial analysis, project management, risk management, and health, environment, safety and security matters.

Yvon Pierre Cariou. Mr. Cariou was appointed director in 2006, and served as President and Chief Executive Officer of the Company from Dynamic Materials Corporation2000 to DMC Global2013. From November 1998 to March 2000, he was President and Chief Executive Officer of Astrocosmos Metallurgical Inc., a division of Mersen Group, which designs and make certain other changes. fabricates process equipment for the chemical and pharmaceutical industries. From 1986 to 1998, Mr. Cariou was the lead executive with five different industrial, material science and manufacturing companies. Earlier in his career, he spent 15 years with Mersen Group, a global industrial components manufacturer, where he held various executive positions in France and the United States, including President of Carbone USA Corp.

Having served as our President and Chief Executive Officer for over 12 years, Mr. Cariou has detailed knowledge of our operations and corporate strategy. In that role, he had primary accountability for accomplishing operational excellence and successfully achieving our corporate strategy. He led and implemented our acquisition of DynaEnergetics in late 2007, increased our share of the worldwide explosion cladding business and diversified the Company's business into oilfields products. From decades of leadership experience with global manufacturing companies, he brings both valuable "process" and "product" expertise and focus to the Board. Mr. Cariou is a graduate engineer from Ecole Nationale Superieure des Arts et Metiers, Paris and he obtained an M.B.A. from Fairleigh Dickinson University, Rutherford, New Jersey.

RationaleRobert A. Cohen. Mr. Cohen has served as a director since February 2011. He is the managing partner of Joranel LLC, a private investment and consulting firm serving institutional clients. Prior to joining Joranel in 2005, Mr. Cohen spent four years as president and Chief Executive Officer of Korea First Bank. Previously, Mr. Cohen worked for Proposed Changes25 years with Credit Lyonnais, including eight years as Chief Executive Officer of Credit Lyonnais USA. He taught economics and finance for 16 years at the Paris Institut Technique de Banque et Finance and the French School of

Name Change

Management (ESSEC). He is a graduate of Ecole Polytechnique in Paris and earned a doctorate in finance from the University Paris Dauphine.

The Board added Mr. Cohen as a member in 2011 because of Directors considershis extensive financial background and his management experience with multinational companies. From his four years serving as Chief Executive Officer of one of the proposed changelargest banks in Korea as well as living in Korea and working with many Korean and Asian companies, he brings rich expertise in the Korean and Asian markets. Many of the key fabricators and end-customers of the Company's name to beexplosion welding division are located in Korea and elsewhere in Asia, and the Company is focusing on this region for sales growth for both its NobelClad and DynaEnergetics business. His management experience also increases the depth of the Board's expertise in the best interestsareas of the Companycorporate governance, strategic planning and its stockholders. We are proposing the name DMC Global Inc., as we are no longer a materials company as implied in Dynamic Materials Corporation. Rather, we are the parent company to a diversified portfolio of technical productleadership, finance and process businesses serving niche markets around the world.risk management.

Changing the corporate name in the manner proposed will not change the Company’s corporate structure. If the proposal is approved and the name change becomes effective, the Company’s common stock will continue to be quoted on the NASDAQ Stock Market under the ticker symbol "BOOM".

If the name change becomes effective, the rights of stockholders holding certificated shares under currently outstanding stock certificates and the number of shares represented by those certificates will remain unchanged. The name will not affect the validity or transferability of any currently outstanding stock certificates nor will it be necessary for shareholders with certificated shares to surrender any stock certificates they currently hold as a result of the name change.

Addition of Indemnification Requirement

We are also proposing to amend the Certificate of Incorporation to add indemnification provisions. Under Section 145 of the Delaware General Corporation Law (the “DGCL”), a Delaware corporationJames J. Ferris. Dr. Ferris has the power to indemnify directors and officers under certain prescribed circumstances against certain costs and expenses, actually and reasonably incurred in connection with any action, suit or proceeding, whether civil, criminal, administrative or investigative, to which any of them is a party by reason of his being a director or officer of the corporation if it is determined that he acted in accordance with the applicable standard of conduct set forth in such statutory provision. As part of the amendment of our Certificate of Incorporation, we are adding a new article (Article VII) that requires us to indemnify any current or former directors or officers to the fullest extent permitted by the DGCL. This indemnification obligation applies to any claim against our directors or officers from serving in that role or from serving at our requestserved as a director since July 2010. From 1994 until his retirement in 2007, he held a variety of positions, including director and president/group chief executive officer, with CH2M Hill Companies Ltd., an employee or agent or another corporation orowned, global engineering, major projects and construction company. Previously, Dr. Ferris spent 18 years with the engineering and construction firm Ebasco Services Incorporated, where he was a director and held various project leadership and senior and executive management positions, including president and chief executive officer of Ebasco Environmental. Dr. Ferris has more than 35 years of diverse, senior and executive level leadership experience in the worldwide engineering, major projects and construction industry. He has been a partnership, joint venture, trust, enterprise or nonprofit entity. The new Article VII requires us to pay expenses incurred in defending any such proceeding in advancemember of the final outcomeG8 Renewable Energy Task Force, an active attendee at The World Economic Forum in Davos, Switzerland, and a member of the Prince of Wales Business Leaders Forum. Dr. Ferris has over 20 years of board experience including with two global engineering, major projects and construction companies, a technology start-up company (Sentegra), and a non-profit enterprise (The Keystone Center) focused on energy, environmental and public health policy initiatives. He has served on seven special purpose mega-project company boards with over $20 billion in capital expenditures, for two of which he acted as chairman. His board committee experience is extensive and includes direct membership and involvement on audit, compensation, nominating and governance, executive, safety and risk management committees.

Dr. Ferris received his undergraduate degree from Marquette University and his Ph.D. in Molecular Microbiology from Rensselaer Polytechnic Institute. He also attended the Advanced Executive Management Program at Wharton. He began his career as a member of the faculty at Rensselaer and transitioned into private industry in 1975. He also has served as an advisor to Rensselaer leadership and has held similar strategic advisory roles with various companies since his retirement from CH2M Hill.

The Board added Dr. Ferris as a member in 2010 because of his previous management and board experience, including his tenure as director and president of two significant multinational companies, his extensive experience in the global energy, environmental, industrial, and national government markets, and his experience overseeing operations and projects in many of the geographic regions where the Company has operations or is working to expand, including China, South Korea, Japan, the Middle East, numerous countries in eastern and western Europe, and elsewhere. He brings significant strategic planning and risk management expertise and successful records of accelerated growth for companies to the Board, especially in light of the Company's broad geographic operations. Dr. Ferris also has strong corporate governance, safety management and compensation policy experience as well as to indemnify for any expenses or other damages incurred by the officer or directorsubstantial financial management skills.

Richard P. Graff. Mr. Graff has served as a resultdirector since June 2007. He is a retired partner of such proceeding or claim. The standard of carePricewaterhouseCoopers LLP where he served as the audit leader in the United States for the rights to indemnification specifiedmining industry, until his retirement in DGCL Section 145 is that the officer or director acted2001. Mr. Graff began his career with PricewaterhouseCoopers LLP in good faith and in1973. Since his retirement, Mr. Graff has been a manner that he or she reasonably believed to be in, or not opposedconsultant to the mining industry and was a member of a Financial Accounting Standards Board task force for establishing accounting and financial reporting guidance in the mining industry. He represents a consortium of international mining companies and has provided recommendations to the International Accounting Standards Board on mining industry issues and to regulators on industry disclosure requirements. Mr. Graff serves on the board of directors of Yamana Gold Inc. and Alacer Gold Corporation (lead independent director). He received his undergraduate degree in Economics from Boston College and his post-graduate degree in Accounting from Northeastern University.

With more than 35 years of experience in public company accounting, including as a partner with a "big four" public accounting firm and consulting on public company accounting policy and practice in the mining industry, Mr. Graff brings substantial insight and experience to the Company, especially with regard to accounting and financial

reporting matters for a company operating worldwide. Mr. Graff has served as a director on boards of public companies since 2005, and currently serves on the board of two other multinational public companies. His experience brings insight to the Board as to best interestspractices with respect to accounting, corporate governance and other issues for multinational public companies.

Clifton Peter Rose. Mr. Rose has served as a director since November 2016. He is a senior advisor to Blackstone, the world’s largest alternative asset manager. From 2007 to 2016, he was a senior managing director with Blackstone, and served as its global head of public affairs. Mr. Rose also spent 20 years with Goldman Sachs, where he was a managing director and held a variety of senior positions in government relations and media relations in Washington DC, New York and Hong Kong. Mr. Rose currently is vice chairman of Sard Verbinnen, one of the corporation. Any future repeal or modificationleading strategic communications firms in the United States. From 1983 to 1987 he was chief of this new Article VII will not adversely affect any right or protection hereunderstaff to Congressman Mike Synar (D-Okla) and a partner with the law firm of any personWilliams and Jensen in respectWashington DC. Mr. Rose is a graduate of any act or omission occurring prior to the time of such repeal or modification.

While we currently provide similar indemnification rights to our directors and officers pursuant to separate indemnification agreements we have entered into with each of our directors and officers, the Board of Directors believes it is in our best interestGeorge Washington University and the best interest of our stockholders that we provide these indemnification rights as allowed byYale Law School. He serves on the DGCL, in the Company’s amended Certificate of Incorporation. We believe the indemnifications provisions added by this new Article VII are usual and customary provisions for public companies. Having these indemnification obligations also included in our amended Certificate of Incorporation provides additional assurance to our directors and officers of their right to indemnification and enhances our ability to retain our existing directors and officers and to recruit new directors and officers when necessary.

Approval and Effectiveness

The Company proposes to effect the amendments to the Certificate of Incorporation through the adoption of an Amended

and Restated Certificate of Incorporation. If approved, the Amended and Restated Certificate of Incorporation will become

effective upon its filing with the Secretary of Statenational board of the State of Delaware. The proposed form ofNAACP, where he also was on the Amended and Restated Certificate of Incorporation is attached as Appendix A and is incorporated by reference in this Proxy Statement, which form is, however, subject to change as may be necessary or required by the Delaware Secretary of State.search committee for its current CEO.

The Board added Mr. Rose as a member in 2016 because of his extensive work with world-leading financial, investment banking and strategic communications firms. As the Company pursues its global growth initiatives, Mr. Rose’s experience reviewing and analyzing acquisitions and investments at Blackstone and his over twenty years of communications experience will provide unique and valuable perspectives to the Board. This broad experience increases the depth of the Board’s expertise in the areas of acquisition analysis, finance, strategic planning and leadership, and risk management.

Requisite Vote

Directors has unanimously approvedare elected by a plurality of the Amended and Restated Certificate of Incorporation. The Board of Directors reserves the right, notwithstanding stockholder approval and without further actionvotes cast by the stockholders, notshares entitled to proceed with the adoption of the Amended and Restated Certificate of Incorporation if, at any time prior to its filing with the Secretary of State of Delaware, the Board of Directors, in its sole discretion, determines that the changes reflected in such documents are no longervote in the best interestselection at a meeting at which a quorum is present. Abstentions and broker non-votes will not be counted as votes cast for purposes of the Company and its stockholders.

Approval of the Amended and Restated Certificate of Incorporation under the DGCL requires the affirmative vote of the holders of a majority of the outstanding shares of voting stock of the Company. The Company has no class of voting stock outstanding other than the common stock.

REQUISITE VOTE

Approval of the Amended and Restated Certificate of Incorporation under this proposal 1 requires the affirmative vote of a majority of the outstanding shares of voting stock of the Company. Broker non-votesand will have no legal effect on this proposalproposal.

THE BOARD RECOMMENDS

A VOTE "FOR" EACH NAMED NOMINEE

Executive Officers

The following individuals serve as our executive officers. Each executive officer is appointed by the Board and abstentionsserves at the pleasure of the Board, subject to the terms of applicable employment agreements or arrangements as described under “Employment Agreements.”

|

| | | |

| | |

| Name | Position | Age |

| Kevin T. Longe | President and Chief Executive Officer | 58 |

|

| Michael Kuta | Chief Financial Officer | 42 |

|

| Michelle H. Shepston | Vice President, Chief Legal Officer and Secretary | 42 |

|

| John Scheatzle | President, NobelClad | 52 |

|

| Ian Grieves | President and General Manager, DynaEnergetics | 48 |

|

Kevin T. Longe. Information regarding Mr. Longe, our President and Chief Executive Officer, is provided under Proposal 1 of this proxy statement under the caption, "Nominees."

Michael Kuta. Mr. Kuta joined the Company on March 31, 2014 as our Chief Financial Officer. From 2007 until joining the Company, Mr. Kuta served in various executive positions with The Lubrizol Corporation, most recently from September 2011 until March 2014 as its corporate controller. From September 2009 until assuming that position, he was the finance manager of Lubrizol’s TempRite Engineered Polymers Business Unit, and before that served Lubrizol as a manager, treasury and capital markets and manager, external financial reporting. Before joining Lubrizol, Mr. Kuta also served in various financial and accounting positions with Lincoln Electric Company and Eaton Corporation. Mr. Kuta received a B.B.A. in Accounting from Kent State University and an M.B.A. from Case Western Reserve University.

Michelle H. Shepston. Ms. Shepston joined the Company on August 30, 2016 as our Vice President, Chief Legal Officer and Secretary. For the previous 16 years, Ms. Shepston was with Denver-based Davis Graham & Stubbs LLP, a leading regional law firm where she was a partner and practiced with the Corporate Finance and Acquisitions Group. Ms. Shepston joins the Company with expertise in securities law, mergers and acquisitions, cross-border equity and debt transactions, and contract negotiation and execution. She has advised public and private company boards on issues of fiduciary duty, risk management and oversight. She also has served a broad spectrum of corporate clients, including several in the energy and natural resource industries. She earned a J.D. from the University of Denver College of Law and a B.S. from the University of Illinois.

John Scheatzle. Mr. Scheatzle joined the Company on November 15, 2016 as president of the Company’s NobelClad business. Prior to joining the Company, he spent the previous 19 years with Materion, an integrated manufacturer of advanced materials for the industrial and consumer products sectors. In his most recent role, he was vice president and general manager of Materion’s Performance Alloys division. He was responsible for North American production facilities and the company’s international sales and distribution centers. He also had oversight of the business’ sales and marketing; research and development; manufacturing; quality; and environmental, health and safety functions. Before his tenure with Performance Alloys, Mr. Scheatzle was general manager of Materion’s Ceramic Products division. He also spent seven years with the consulting firm Accenture, where he was a senior manager and worked with clients in the consumer products, chemicals manufacturing, and metals industries. Mr. Scheatzle holds an M.B.A. with a concentration in marketing and manufacturing from Case Western Reserve University. He earned a B.S. in business administration from the University of Akron.

Ian Grieves. Mr. Grieves serves as President and General Manager of DynaEnergetics, having previously served as Senior Vice President and Managing Director of DynaEnergetics from his appointment in January 2013. From 2006 until joining the Company, Mr. Grieves was employed by Lydall Inc., as senior vice president of the company’s performance materials division (2010-2013), and as vice president and general manager Europe of the company’s filtration division (2006-2010). From 1995 to 2005, he was employed in various financial and general management positions with AAF International Inc., with his last position being that of vice president and general

manager of AAF Europe (2003-2005). Mr. Grieves studied Economics and graduated from the University of Sunderland, United Kingdom.

Board of Directors

Meeting Attendance

Directors are encouraged to attend our Annual Meeting of Stockholders. All of our directors attended the 2016 Annual Meeting of Stockholders and plan to attend the 2017 Annual Meeting of Stockholders.

During the fiscal year ended December 31, 2016, each of our current directors attended more than 75% of the aggregate of (i) the number of meetings of the Board held during the period in which he was a director and (ii) the number of meetings of the committees on which he served.

Director Independence

The Board has determined that seven of the eight current directors nominated for re-election, Messrs. Aldous, Cariou, Cohen, Ferris, Graff, Munera and Rose, are “independent” directors under the rules promulgated by the Securities and Exchange Commission (“SEC”) and the applicable rules of the NASDAQ. In making its determinations of independence, the Board considered factors for each director such as any other directorships, any employment or consulting arrangements, and any relationship with our customers or suppliers. The Board determined that there were no related-party transactions or other relationships that needed to be considered in evaluating whether these directors are “independent.” Mr. Longe, our President and Chief Executive Officer is the only Board member nominated for re-election who is not independent based on these criteria.

All current members of the Audit Committee, the Compensation Committee, and the Corporate Governance and Nominating Committee are independent directors. Our independent directors hold regularly scheduled meetings in executive session, at which only independent directors are present.

Board Leadership Structure

The Board does not have a policy on whether the Chairman and Chief Executive Officer positions should be separate or combined. The Company currently separates the positions of Chairman and Chief Executive Officer. Our Chief Executive Officer is responsible for setting the strategic direction for the Company and the day to day leadership and performance of the Company, while our Chairman of the Board oversees the Board, sets Board agendas, facilitates communication between the Chief Executive Officer and the rest of the Board and provides guidance to the Chief Executive Officer. Our Chairman’s long tenure with the Board makes him ideally suited for carrying out these responsibilities. We believe our Chief Executive Officer and Chairman have an excellent working relationship that allows the Chief Executive Officer to focus the requisite time and energy on the Company’s businesses, people and growth opportunities.

Our Board has seven independent members and only one non-independent member, the Chief Executive Officer. A number of our independent Board members are currently serving or have served as senior management of other public companies and are currently serving or have served as directors of other public companies. We believe that the number of independent, experienced directors, along with the independent oversight of the Board by our non-executive Chairman, benefits the Company and our stockholders.

The Board determines the best Board leadership structure for the Company from time to time. We recognize that different board leadership structures are appropriate for companies in different situations. We believe our current leadership structure, with Mr. Munera serving as Chairman and Mr. Longe serving as Chief Executive Officer, is the optimal structure for the Company at this time.

Board Committees and Meetings

During the fiscal year ended December 31, 2016, the Board held five meetings. The Board currently has an Audit Committee, a Compensation Committee, a Corporate Governance and Nominating Committee and a Health, Safety, Security and Environment Committee.

The Audit Committee

The Audit Committee meets with our independent registered public accounting firm at least four times a year to review quarterly financial results and the annual audit, discuss financial statements and related disclosures, and receive and consider the accountants’ comments as to internal control over financial reporting, adequacy of staff and management performance and procedures in connection with the annual audit and internal control over financial reporting, The Audit Committee also appoints the independent registered public accounting firm. Messrs. Graff and Cohen were members of the Audit Committee for the full year 2016, with Mr. Graff serving as Chairman. Messrs Aldous and Ferris served as members of the Audit Committee until May 19, 2016, and on that same date Mr. Munera became a member of the Audit Committee. All members of the Audit Committee are non-employee directors whom the Board has determined to be “independent” as that concept is defined in Section 10A of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the rules promulgated by the SEC thereunder, and the applicable rules of the NASDAQ. The Audit Committee has determined that Messrs. Graff, Munera and Cohen qualify as “audit committee financial experts” under the rules of the SEC. During 2016 the Audit Committee met eight times.

In 2000, the Board adopted a written Charter of the Audit Committee, which was subsequently updated and revised in 2004, 2007, 2012 and 2017. The Charter of the Audit Committee requires the Audit Committee be comprised of three or more independent directors, at least one of whom qualifies as an “audit committee financial expert” as defined in Item 407(d)(5) of SEC Regulation S-K. The Charter of the Audit Committee charges the Audit Committee with the responsibility of reviewing any related party transactions for potential conflicts of interest pursuant to our Related Party Transaction Policy and Procedures, which are described in more detail under, “Certain Relationships and Related Transactions.” The Charter of the Audit Committee may be viewed on our website, www.dmcglobal.com.

The Compensation Committee

The Compensation Committee makes recommendations concerning salaries and incentive compensation, grants equity-based awards to employees and non-employee directors under our stock incentive plan and otherwise determines compensation levels and performs such other functions regarding compensation as the Board may delegate. The Compensation Committee is also responsible for reviewing and approving the Compensation Discussion and Analysis included in the Company’s proxy statement. The Compensation Committee has authority to retain such compensation consultants, outside counsel and other advisors as the Compensation Committee in its sole discretion deems appropriate. Messrs. Cohen, Ferris and Munera were members of the Compensation Committee for the full year 2016, with Mr. Cohen serving as the Chairman. All members of the Compensation Committee are non-employee directors whom the Board has determined to be “independent” under SEC and NASDAQ rules. During 2016 the Compensation Committee met four times.

In 2006, the Board adopted a written Charter of the Compensation Committee, which was subsequently updated and revised in 2007, 2012, 2014 and 2017. The Charter of the Compensation Committee may be viewed on our website, www.dmcglobal.com.

Compensation Committee Interlocks and Insider Participation

We do not have any interlocking relationships between any director who currently serves or served during 2016 as a member of our Compensation Committee and any of our executive officers that would require disclosure under the applicable rules promulgated under the U.S. federal securities laws.

The Corporate Governance and Nominating Committee

The Corporate Governance and Nominating Committee recommends director nominees and sets corporate governance policies for the Board and Company. For the full year 2016, Messrs. Ferris, Aldous, and Graff were members of the Corporate Governance and Nominating Committee, with Dr. Ferris serving as Chairman of the Committee. Mr. Cariou was appointed as a member of the Corporate Governance and Nominating Committee on March 2, 2016. All members of the Corporate Governance and Nominating committee are non-employee directors whom the Board has determined to be “independent” under the SEC and NASDAQ rules. The main purposes of this Committee are (i) to identify and recommend individuals to the Board for nomination as members of the Board and its committees; (ii) to

develop and recommend to the Board corporate governance principles applicable to the Company; (iii) to oversee the Board’s annual evaluation of its performance; and (iv) to undertake such other duties as the Board may from time to time delegate to the Committee. The Corporate Governance and Nominating Committee held three meetings during 2016. The Charter of the Corporate Governance and Nominating Committee, which was adopted in 2006 and revised in 2012 and 2017, may be viewed on our website, www.dmcglobal.com.

The Company does not have a formal policy regarding the consideration of director candidates recommended by stockholders; however, the Corporate Governance and Nominating Committee reviews recommendations and evaluates nominations received from stockholders in the same effectmanner that potential nominees recommended by Board members, management or other parties are evaluated. Stockholders may nominate persons for election to the Board in accordance with our Bylaws. Any stockholder nominations proposed for Board consideration should include the nominee’s name and qualifications for Board membership and should be mailed to DMC Global Inc., c/o Corporate Secretary, 5405 Spine Road, Boulder, Colorado 80301, or faxed to (303) 604-1897.

Qualifications for consideration as a director nominee may vary according to the particular area of expertise being sought as a complement to the existing Board composition. However, in making its nominations, the Corporate Governance and Nominating Committee considers, among other things, an individual’s business experience, industry experience, financial background, breadth of knowledge about issues affecting our business, time available for meetings and consultation, integrity, independence, diversity of experience, leadership and relevant skills and experience l. Diversity is considered in the nominating process as described above and in our Governance and Nominating Committee Charter, which provides that we develop and recommend to the Board the criteria for Board membership.

In 2014, our Board adopted governance guidelines prepared by the Corporate Governance and Nominating Committee, and these guidelines were updated in February 2017. Among other things, the guidelines provide that directors should serve no longer than a total of 15 years as a non-employee director or after the director’s 75th birthday, with the Governance and Nominating Committee under the direction of the Board, empowered to make exceptions in extraordinary circumstances. The Board and Governance and Nominating Committee have determined that the Company’s circumstances warrant the nomination of Mr. Munera for re-election as a director this year despite his age and length of service.

We do not currently employ an executive search firm or pay a fee to any other third party to locate qualified candidates for director positions.

The Health, Safety, Security and Environment Committee

In 2009, at the direction of the Board, the Company established a Quality and Safety Committee (subsequently renamed the Safety Committee) comprised of the Company’s Chief Executive Officer, two independent directors and up to three Company managers. In 2013, the Board made the Safety Committee a committee of the Board, adding additional directors to serve on this Committee and renaming it the Health, Safety, Security and Environment Committee (“HSSE Committee”) to reflect its increased scope of purpose and oversight. The HSSE Committee is currently comprised of three directors and chaired by an independent director. Mr. Aldous currently serves as Chairman of the HSSE Committee, and the other member of the HSSE Committee are Messrs. Cariou and Longe, as well as the Company’s vice president, corporate health, safety, security and environment, all of whom served on the HSSE Committee for the full year 2016.

The purpose of the HSSE Committee is to review the Company’s performance in meeting its health, safety, security and environmental objectives established by management and to facilitate the Board’s oversight of these critical operational issues. The HSSE Committee met four times during 2016 and also completed inspections of the Company’s manufacturing facilities in Germany.

Risk Oversight

Our senior management manages the risks facing the Company under the oversight and supervision of the Board. The Company has a global Enterprise Risk Management (“ERM”) team. The ERM team’s objectives include, but are

not limited to, reporting on the ERM process and risk findings to the Board on a quarterly basis. While the full Board is ultimately responsible for risk oversight at our Company, two of our Board committees assist the Board in fulfilling its oversight function in certain areas of risk. The Audit Committee assists the Board in fulfilling its oversight responsibilities with respect to risk in the areas of financial reporting, including cybersecurity and other risks related to the Company’s computerized information system controls and security, and internal controls. The HSSE Committee assists the Board in fulfilling its oversight responsibilities with respect to the management of risks related to operations, including health, safety, security and environment. Other general business risks such as economic and regulatory risks are monitored by the full Board.

Communications with the Board

The Board believes that it is important for stockholders to have a process to send communications to the Board. Accordingly, stockholders desiring to send a communication to the Board, or to a specific director, may do so by delivering a letter to our Secretary at DMC Global Inc., c/o Corporate Secretary, 5405 Spine Road, Boulder, Colorado 80301 or fax to (303) 604-1897. The mailing envelope or fax cover sheet must contain a clear notation indicating that the enclosed letter is a “Stockholder-Board Communication” or “Stockholder-Director Communication.” All such letters must identify the author as a stockholder and clearly state whether the intended recipients of the letter are all members of the Board or specified individual directors. The Secretary will open such communications and make copies and then circulate them to the appropriate director or directors.

PROPOSAL 2—NON-BINDING ADVISORY VOTE TO APPROVE EXECUTIVE COMPENSATION

Despite a three-year downturn in the global energy industry, our management team has made significant progress in ensuring the continued health and success of the Company:

Restructuring and investment in research, technology and application development have positioned the business to be successful in the current challenging environment.

The improvement in our TSR indicates that the market acknowledges these efforts despite continued challenges in energy markets in 2016. The Company also adopted a new peer group, which includes energy and oil field services peer companies, to more accurately reflect the business of the Company.

The executive compensation program has played a critical role in retaining the key members of our management team and motivating them to focus on long-term share value creation.

As described in the introduction to this Proxy Statement and in the Compensation Discussion & Analysis, compensation for the Named Executive Officers is significantly performance based, and the gap between grant value compensation and compensation actually realized attests to the significant stretch in the performance goals.

Pursuant to Section 14A of the Securities Exchange Act, as amended and SEC rule 14a-2(a) we are providing our stockholders the opportunity to vote againston a non-binding advisory resolution to approve the compensation of our named executive officers (“Say on Pay”) which is described in this Proxy Statement. Currently, we are providing these advisory votes on an annual basis. Following the 2017 Annual Meeting, the next advisory Say-on-Pay vote is anticipated to be held at our 2018 Annual Meeting of Stockholders.

“RESOLVED, that the compensation paid to the Company’s named executive officers, as disclosed pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the Compensation Discussion and Analysis, compensation tables and narrative discussion in the Company’s proxy statement is hereby APPROVED.”

Requisite Vote

The advisory vote on the compensation of our named executive officers will be approved by the majority of votes cast on this proposal. Abstentions and broker non-votes will not be counted as votes cast on the proposal. Our Board and our Compensation Committee value the opinions of our stockholders and will consider the outcome of the vote when considering future decisions on the compensation of our named executive officers. However, this say-on-pay vote is advisory, and therefore not binding on the Company, the Compensation Committee or our Board.

THE BOARD RECOMMENDS

A VOTE “FOR” APPROVAL OF PROPOSAL 12.

PROPOSAL 3—NON-BINDING ADVISORY VOTE ON THE FREQUENCY OF

ADVISORY VOTES ON EXECUTIVE COMPENSATION

As described in Proposal 2 - APPROVALabove, in accordance with the requirements of Section 14A of the Exchange Act and the related rules of the SEC, our stockholders have the opportunity to cast an advisory vote to approve the compensation of our named executive officers. This Proposal 3 affords our stockholders the opportunity to vote, on a non-binding advisory basis, on how frequently we should seek an advisory vote on the compensation of our named executive officers, such as Proposal 2 above. The enclosed proxy card gives our stockholders three choices for voting on this Proposal 3. You can choose whether the say-on-pay vote should be conducted every year, every two years, or every three years.

The results of our advisory vote on the frequency of say-on-pay proposals in 2011 resulted in stockholders favoring a say-on-pay vote on an annual basis, and we have elected to present our say-on-pay proposals on that basis. Our Board has discussed and carefully considered the alternatives regarding the frequency of say-on-pay proposals, and believes that continuing annual advisory votes on executive compensation is appropriate for us and our stockholders at this time.

When you vote in response to the resolution below, you may cast your vote on your preferred voting frequency by choosing among the following three options: every year, every two years, or every three years.

“RESOLVED, that the Company hold a stockholder advisory vote to approve the compensation of the Company’s named executive officers, as disclosed pursuant to the compensation disclosure rules of the Securities and Exchange Commission, with a frequency of once every year, every two years or every three years, whichever receives the highest number of votes cast with respect to this resolution.”

Requisite Vote

The frequency of the advisory vote on executive compensation receiving a majority of votes cast-every year, every two years or every three years-will be considered the frequency recommended by stockholders. If none of the three alternatives receives such vote, the Board will consider the alternative that receives the most votes to be the frequency recommended by stockholders. Abstentions and broker non-votes will not be counted as votes cast on the proposal. This vote is advisory and therefore not binding, and the Board may decide in the future that it is in the best interests of our stockholders and the Company to hold an advisory vote on executive compensation more or less frequently than the option approved by our stockholders.

THE BOARD RECOMMENDS

A VOTE FOR “EVERY YEAR” AS THE FREQUENCY

FOR ADVISORY VOTES ON EXECUTIVE COMPENSATION.

PROPOSAL 4—AMENDMENT OF THE COMPANY’S 2016 OMNIBUS INCENTIVEEMPLOYEE STOCK PURCHASE PLAN

We are asking stockholders to approve an amendment to the Dynamic Materials CorporationDMC Global Inc. Employee Stock Purchase Plan, as amended (the “Company”“ESPP”) 2016 Omnibus Incentive, to, among other things, increase the number of shares of our common stock available for purchase by 250,000 shares.

Purpose of the Employee Stock Purchase Plan (the "2016 Plan").

The Boardpurpose of Directors has adopted the 2016 Plan, subjectESPP is to approvalprovide eligible employees of the Company and its affiliates with a program for the regular purchase of our common stock from the Company through periodic payroll deductions. The ESPP gives participating employees a convenient and cost-effective means of acquiring a proprietary interest in the Company. Under the ESPP, employees acquire our common stock at the Special Meeting.lesser of (i) 85% of the market price on the date rights are granted, or (ii) 85% of the market price on each purchase date for such rights.

Background

The ESPP previously authorized the sale of 600,000 shares of our common stock. Employee participation in our ESPP has increased every year since inception of the plan. Currently, approximately 10% of our employees make regular contributions and purchases through the plan. The average aggregate number of shares purchased on each purchase date during 2016 by all participants in the ESPP was 22,944. As of March 24, 2017, a total of 564,016 shares of common stock had been purchased under the ESPP by eligible employees, leaving 35,984 shares available for subsequent purchases. If stockholders approve the 2016 Plan at the Special Meeting, the 2016 Plan will become effective on November 4, 2016 and terminate on November 4, 2026. Regardless of whether the 2016 PlanESPP is approved, the Company’s 2006 Stock Incentive Plan (the “2006 Plan” or “Prior Plan”)number of shares available for purchase under the ESPP will terminate on September 21, 2016, though such terminationincrease by 250,000 to 285,984. If stockholder approval is not obtained, then the amendment to the ESPP will not impact awards previously granted underbe implemented, and the 2006 Plan.ESPP will continue in effect pursuant to its current terms. Approval of the ESPP will ensure that sufficient shares are available for purchase by our employees for the next several years.

Summary of the 2016 Omnibus Incentive PlanESPP

The following paragraphs provide a summary of the principal featuresmaterial terms of the 2016 Plan. This summaryESPP does not purport to be complete and is subject to and qualified in its entirety by the provisionsactual terms of the 2016 Plan, whichplan. A copy of the Amendment is attachedprovided as Appendix A to this proxy statement as Proxy Statement.

Appendix BParticipation. Capitalized terms used herein and not defined shall have the same meanings set forth in the 2016 Plan.

Background and Objectives. The objectives of the 2016 Plan are to attract and retain the best available personnel for positions of substantial responsibility, to provide additional incentive to Participants and to optimize the profitability and growth of the Company through incentives that are consistent with the Company’s goals and that link the personal interests of Participants to those of the Company’s stockholders. The 2016 Plan permits the grant of the following types of incentive awards: (1) Options, (2) SARs, (3) Restricted Stock, (4) RSUs, (5) Performance Shares, (6) Performance Units, (7) Other Stock-Based Awards, and (8) Cash-Based Awards (each individually, an “Award”).

Shares Subject to the 2016 Plan. The number of shares of the Company’s Common Stock (“Shares”) initially reserved for issuance under the 2016 Plan is 5,000,000 shares, 2,617,500 of which are rolled over from our 2006 Stock Incentive Plan. To the extent that an Award under the 2016 Plan or an award under the Prior Plan is canceled, expired, forfeited, settled in cash, settled by issuance of fewer Shares than the number underlying the Award, or otherwise terminated without delivery of shares to the Participant, the Shares retained or returned to the Company will again be counted for purposes of determining the maximum number of Shares available for award under the Plan. Shares that are tendered or withheld in payment of all or part of the Exercise Price of an Award or in satisfaction of tax withholding obligations, shall not be included in or added to the number of Shares available for issuance under the 2016 Plan. The market value of a Share as of September 12, 2016 was $10.75.

Administration. The 2016 Plan is administered by a committee of the Board (the “Committee”). The Board of Directors has currently designated the Compensation Committee as the Committee for the 2016 Plan. Subject to the provisions of the 2016 Plan, the Committee has the authority to: (1) select the persons to whom Awards are to be granted, (2) determine whether and to what extent Awards are to be granted, (3) determine the size and type of Awards, (4) approve forms of agreement for use under the 2016 Plan, (5) determine the terms and conditions applicable to Awards, (6) establish performance goals for any Performance Period and determine whether such goals were satisfied, (7) amend any outstanding Award subject to shareholder approval as described below and participant consent in certain circumstances, (8) construe and interpret the 2016 Plan and any Award Agreement and apply its provisions and (9) subject to certain limitations, take any other actions deemed necessary or advisable for the administration of the 2016 Plan. All decisions, interpretations and other actions of the Committee shall be final and binding on all holders of Options or rights and on all persons deriving their rights therefrom. Subject to applicable law, the Committee may delegate its authority under the 2016 Plan.

Eligibility to Receive Awards. The 2016 Plan provides that Awards may be granted to Participants, which include all Employees, Directors, and Consultants of the Company, except that Incentive Stock OptionsRights may be granted only to Employees. The approximate numberemployees of personsthe Company or, as the Board or the ESPP Committee (as described below) may designate, to employees of any affiliate of the Company. With certain exceptions, an employee of the Company or any affiliate shall not be eligible to participatebe granted rights under the ESPP, unless, on the date rights to acquire common stock are offered (“Offering Date”), such employee has been in the 2016 Plan is 416.

Code Section 162(m). The Company has designed the 2016 Plan so that it permits the issuance of Awards that are intended to qualify as performance-based under Section 162(m)employ of the Internal Revenue CodeCompany or any affiliate for such continuous

period preceding such grant as the Board or the ESPP Committee may require, but in no event shall the required period of 1986, as amended (the “Code”).